The Haircut in the Stock Market: Understanding Margin Calls and Liquidation

The stock market, a vibrant ecosystem of buying and selling securities, operates on a delicate balance of risk and reward. One critical aspect of this balance, often shrouded in complexity, is the concept of the "haircut" in margin trading. Understanding haircuts is crucial for both investors leveraging borrowed funds and lenders providing the credit, as it directly impacts the risk profile and potential for financial distress. This article delves deep into the mechanics of haircuts, exploring their implications for margin calls, liquidation, and the overall stability of the market.

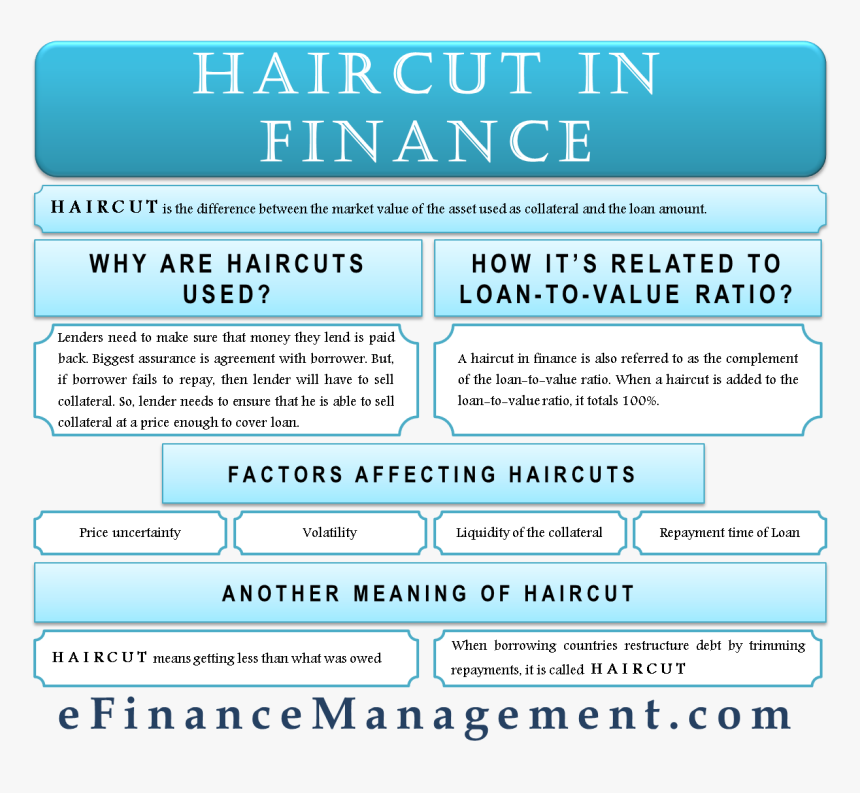

What is a Haircut in the Stock Market?

In the context of margin trading, a haircut refers to the percentage reduction applied to the value of collateral pledged by a borrower to secure a loan. Essentially, it’s a buffer built into the system to account for potential fluctuations in the asset’s price. When an investor borrows money to buy stocks (margin trading), they use their existing securities as collateral. The lender, typically a brokerage firm, assesses the value of this collateral and applies a haircut to determine the loan-to-value (LTV) ratio. This ratio represents the percentage of the asset’s value that the lender is willing to finance.

For example, if an investor wants to borrow $50,000 to buy stocks and the lender applies a 30% haircut to the collateral, the investor needs to pledge $71,429 worth of securities ($50,000 / (1 – 0.30)). This ensures that even if the value of the securities declines by 30%, the lender still has enough collateral to cover the loan. The haircut acts as a safety net, protecting the lender from losses if the market turns sour.

Factors Determining Haircut Size

The size of the haircut applied varies significantly depending on several factors:

-

Asset Type: The inherent volatility of the asset plays a crucial role. Highly volatile assets like penny stocks or emerging market equities will generally attract larger haircuts compared to established blue-chip stocks or government bonds. The perceived risk associated with the asset directly influences the lender’s required margin of safety.

-

Market Conditions: During periods of market uncertainty or heightened volatility, lenders tend to increase haircuts to mitigate their risk exposure. This is a proactive measure to protect against potential losses in case of a market downturn. Conversely, in stable market environments, haircuts might be smaller, reflecting a lower perceived risk.

-

Creditworthiness of the Borrower: Investors with a strong credit history and a proven track record of responsible investing might be offered lower haircuts. Lenders assess the borrower’s financial stability and risk profile, adjusting the haircut accordingly. A borrower with a history of defaults or erratic trading activity will likely face larger haircuts.

-

Loan-to-Value Ratio (LTV): The desired LTV ratio is another key determinant of the haircut. A lower LTV ratio implies a smaller loan relative to the collateral’s value, resulting in a smaller haircut. Conversely, a higher LTV ratio necessitates a larger haircut to maintain the lender’s risk tolerance.

-

Lender’s Risk Appetite: Each lender has its own risk appetite and internal policies governing haircut determination. Some lenders might be more conservative and apply larger haircuts across the board, while others might take a more lenient approach. This difference in risk appetite contributes to the variation in haircuts observed in the market.

The Role of Haircuts in Margin Calls

A margin call is a demand from a lender to an investor to deposit additional funds or securities into their margin account to bring the account’s equity back above the maintenance margin requirement. This typically happens when the value of the collateral falls below a certain threshold, triggering the margin call. The haircut plays a direct role in determining this threshold. A larger haircut lowers the threshold, increasing the likelihood of a margin call.

Imagine an investor with $100,000 worth of stocks as collateral, borrowing $50,000 with a 20% haircut. The maintenance margin requirement might be 30%. If the value of the stocks drops to $70,000, the equity in the account is only $20,000 ($70,000 – $50,000), which represents only 28.6% of the initial collateral value. This falls below the 30% maintenance margin, triggering a margin call. The investor needs to deposit additional funds or securities to meet the requirement, or face liquidation.

Liquidation and the Haircut’s Impact

If an investor fails to meet a margin call within the stipulated timeframe, the lender has the right to liquidate the investor’s collateral to recover the outstanding loan amount. The haircut significantly influences the outcome of this liquidation. A larger haircut, while initially protecting the lender, might lead to a greater loss for the investor. This is because the investor might need to sell their assets at unfavorable prices to meet the margin call, potentially incurring substantial losses.

The liquidation process itself can further exacerbate losses. Forced selling of large quantities of securities can depress prices, leading to a negative feedback loop. The investor might receive less for their assets than their market value before the margin call, increasing the overall financial impact.

Haircuts and Systemic Risk

The widespread application of haircuts throughout the financial system plays a crucial role in managing systemic risk. By incorporating a buffer into margin lending, haircuts help to prevent a cascade of margin calls and forced liquidations that could destabilize the market. However, the effectiveness of haircuts in managing systemic risk depends on their accuracy and consistency. Inaccurate or inconsistent haircuts can lead to unexpected losses for lenders and contribute to market instability.

Furthermore, the regulatory environment surrounding haircuts influences their effectiveness. Stricter regulations and oversight can ensure that haircuts are appropriately determined, reducing the risk of excessive leverage and market instability. Conversely, lax regulations might lead to inadequate haircuts, increasing the vulnerability of the financial system.

Conclusion: Navigating the Complexities of Haircuts

Haircuts are an integral part of the stock market’s risk management framework. They represent a critical mechanism for lenders to protect themselves against potential losses associated with margin lending. Understanding the factors that influence haircut size, the relationship between haircuts and margin calls, and the implications of liquidation are essential for both investors and lenders. Investors should carefully consider their risk tolerance and leverage levels when engaging in margin trading, recognizing the potential for margin calls and the subsequent impact on their portfolio. Lenders must also carefully assess the risk associated with each loan, ensuring that haircuts are appropriately determined to mitigate potential losses. The interplay between haircuts, margin calls, and liquidation highlights the delicate balance between risk and reward in the stock market and the importance of a robust regulatory framework to maintain market stability. The ever-evolving nature of the market necessitates continuous monitoring and adaptation of haircut policies to ensure resilience and prevent systemic crises. Therefore, a thorough understanding of haircuts is not just beneficial but crucial for navigating the complexities of the stock market successfully.